- Compliance with the formal and essential tax requirements

- Extending the links of confidence between the corporation and authority with all its representatives

- Evading the commitment of legal mistake

- Drawing a documentary and book cycle that matches the tax requirements

- Tax auditing before taking decision

Our approach in managing the tax process

Proper and accurate planning is not trivial, it is a necessity

-Thomas Peter

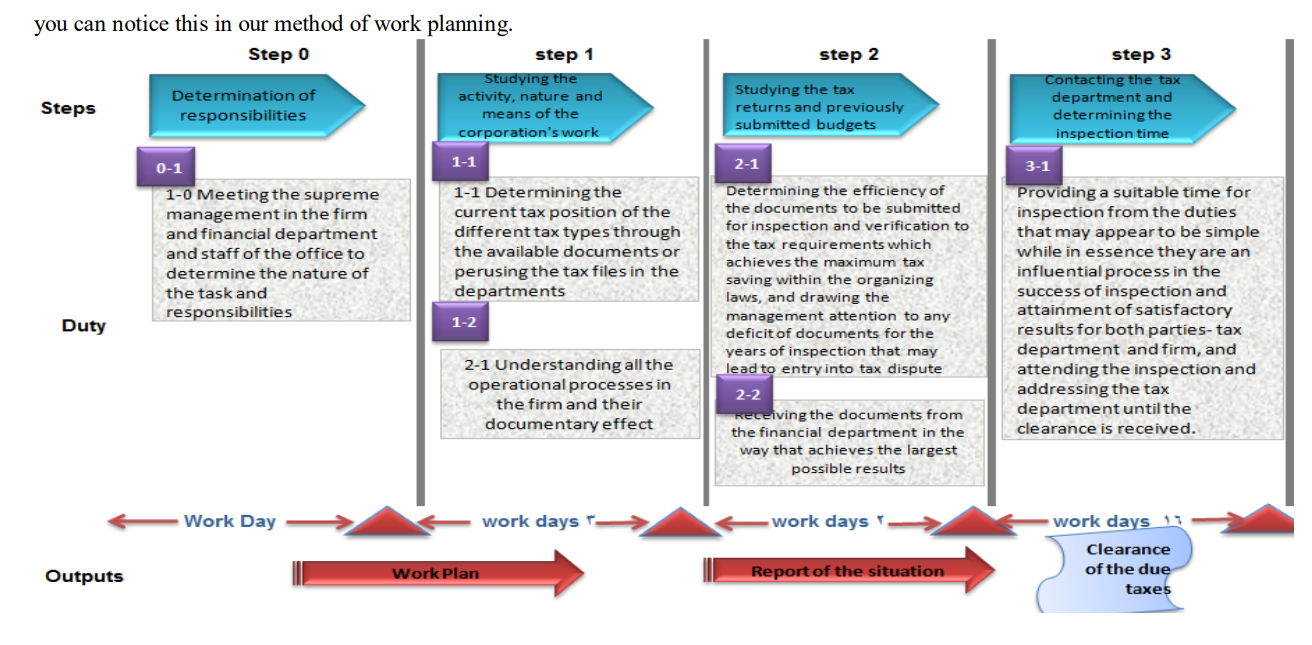

The projects that will achieve success within the coming years are those that try to exert serious and conscious efforts to understand and accommodate the international economic approaches, and to plan all its works professionally. Our management of the tax process is characterized by professionalism.

PAYROLL TAX AND THE LIKE

We prepare and present the tax return according to the provisions of law tax 91 for the year 2005, and its executive regulation. The approved financial statements for the financial year are prepared in the tax terms in the way that matches the applications of the new law. In addition, we attend the special examination and make communications with the tax department to finalize the differences that may arise and respond to the inquiries. In case of difference between the company and the competent tax department, our office will examine the situation and represent the company before the internal committees and appeal committees, and prepare the briefs of defense to reach the best results and to reduce the tax burden of the company

TAX ON COMPANIES’ PROFIT

We draw the attention of the company to how to utilize the tax and legal exemptions by reducing the tax burden by largest possible amount on the company’s staff and we will:

• Direct the company to how to reserve the tax from the employee according to the monthly salary settlement that we prepare and supply the due tax to the staff of the company to the competent tax department within the first fifteen days of the next month.

• Prepare and present quarterly tax return to the tax department in the months of April- July- October- January- every year to form 4, salaries, prepared for the same, including all the staff of the company and their salaries and the like, and the withheld amounts under the tax account.

• Preparing the monthly salaries settlement and submitting it within the due time before the end of January every year in the way that conforms to the monthly reconciliations prepared in advance.

• Submitting the tax reconciliations to the tax department and explaining how these reconciliations are prepared to the tax commissioner during the tax inspection.

• Perusing and examining the inspection report prepared to the best knowledge of the tax department and responding to the notes in it, and preparing any data or analyses according to this study.

• Preparing the challenge briefs according to the inspection report and submitting them to the internal committee and the appeal committees and discussing the committee in the differences to reach the best possible results of reducing the tax burden on the company as much as possible.

Deduction and collection under the tax account

We provide another tax service to the company that needs to be familiar with the laws of taxes and investment guarantees and incentives, and the requirements of tax inspection according to our experience as for the opinion on all the tax problems. The main works include:

• Preparing and submitting the deduction and collection forms under the account of the companies’ tax on form (41), deduction and collection. Helping the company to identify the percentages of deduction and collection under the account of the tax according to the nature of work with the different companies and according to the provisions of income tax law 91 for the year 2005.

• Paying the deduction and collection tax under the account of the company’s tax in the normal times at the end of (AprilJuly- October- January)

• Attending the deduction and collection tax under the tax account to make the maximum saving to the company

Withholding Tax

We provide our directions in time to deduct the withholding amounts from any amounts transferred out of Egypt according to the provision of article 56 of law 91 for the year 2005, and calculate the amount and submit it to the department and include it in the tax returns. We give the foreign party a voucher of the tax payment in Egypt according to the provisions of the organizing international agreements

Stamp Duty

We attend the tax inspection and receive the forms and submit objections, and prepare the data and documents and attend the internal committees and challenge committees, and prepare the briefs to reach the best results.

VAT Tax

– We provide assistance and consultancy in the preparation of the monthly tax return in case the company so desires, or audit the tax return every month, and confirm and verify the documents and prepare the required data to calculate the tax truly under the available data and documents and confirm that the company submitted the tax return of the last month.

– Attending the tax inspection and receiving the forms, submitting the grievances and attending the primary arbitration and financial arbitration and preparing the notes to reach the best results.